MSME Registration is for Micro, Small and Medium Enterprises. Government has made various policies and scheme to upgrade these small scale industries and to promote good business practices within these industries.

Easy loan availability is one of the beneficial aspects of registering as an MSME in India. Want to know how to avail it? Follow below-given instructions carefully to get a MSME loan in 59 minutes after MSME Registration:

MSME Loan in 59 Minutes was introduced on 2nd November 2018 by the Indian Government for supporting Micro, Small and Medium Enterprises (MSME’s). Under this scheme, fast loans are provided to the MSME industries of up to Rs.1 crore in less than 1 hour. Here are some of the interesting features of this scheme:

Following banks provide loan to the MSMEs under this scheme:

Only a few documents are required to get a loan under this scheme. They are given as follows:

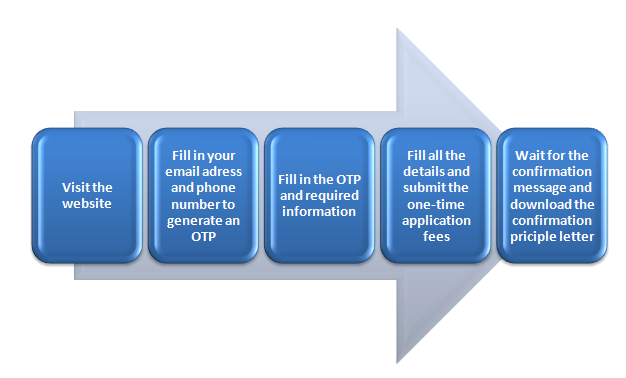

To apply for a loan you need to file an online application in a prescribed format as given below: